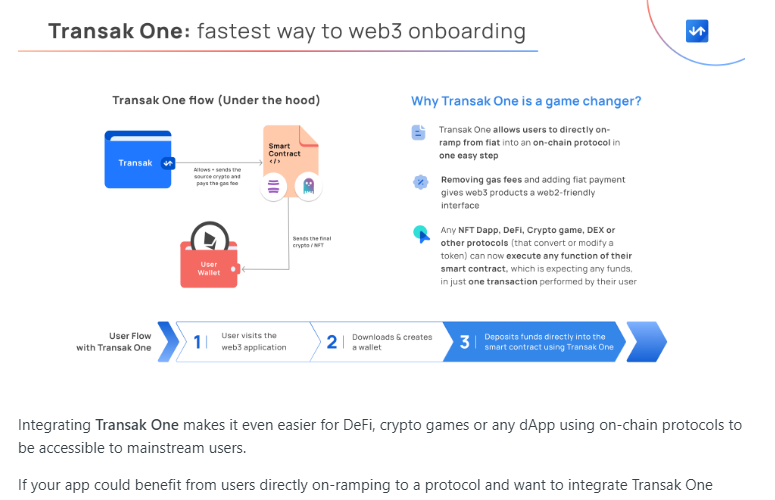

Transak is a developer integration toolkit that enables application developers to onboard users to buy or sell crypto with any blockchain application, website or web plugin. While utilizing the firm’s infrastructure, developers can onboard mainstream users into their decentralized applications, protocols, games or wallet applications and at the same time, increase their revenues.

Transak has recently secured $20 million in a series A financing round that was led by CE Innovation Capital and garnered participation from other investment firms and venture capitals including SBI Ven Capital, Sygnum Bank, Azimut, Third Kind Venture, UOB Venture Management, Signum Venture, Animoca Brands, Genting Ventures, Istari Ventures and No Limit Holdings among several others.

Transak aims to utilize the proceeds from this funding round to facilitate continued global expansion and help build out the onboarding solutions. These solutions include those for web3 games and financial applications.

In a nutshell, Transak is a web3 payments startup that is enabling users to buy or sell crypto from their apps. This utility is available in a wide range that supports over 160 cryptocurrencies on more than 75 blockchains via cards, bank transfers and other payment solutions across 150 countries.

The firm’s infrastructure is trusted by notable wallet providers including Metamask, Coinbase Wallet, Avalanche, Ledger, Bitcoin.com and Trust Wallet among other providers. The firm also powers several notable DeFi(Decentralized Finance) firms and decentralized gaming and NFTs(Non-Fungible Tokens) providers.

The firm’s infrastructure has been designed for developers to enable easy integrations that utilize few lines of code. The infrastructure also includes highly customizable SDKs(Software Development Kits) for all major platforms and languages including React.js, Vue.js, Angular.js, React Native and android.

The firm also offers a whitelabel API(Application Programming Interface) that is modular in nature and enterprise-grade to enable customization of the user flow. This includes a partner dashboard that enables developers to configure their integrations and manage their accounts post go-live.

Apart from global payment methods, Transak also offers other services including liquidity that is sourced from more than 10 exchanges to offer best prices and a robust risk engine that boasts of a fraud rate of less than 0.05%.