ZkLink is a web3 firm offering unified multi-chain trading infrastructure secured with zk-SNARKS. The firm’s products are aimed at empowering the next generation of decentralized trading products. ZkLink is built around Zero-Knowledge rollups that scale the Ethereum blockchain. The zk(Zero Knowledge) approach is efficient as it mathematically proves the validity of off-chain transactions therefore, saving valuable time, increasing a network’s throughput and reducing transaction costs. By offering a unified multi-chain trading layer for DeFi(Decentralized Finance) and NFTs(Non-Fungible Tokens), the platform’s infrastructure is set to make cross-chain transactions seamless and efficient while still maintaining the same level of security as layer-1 chains.

ZkLink has recently, raised $10 million in a strategic funding round. The funding round was led and lined up by the venture capital arm of crypto exchange Coinbase(COIN). The round also garnered participation from other investment firms including Ascensive Assets, SIG DT Investments, Big Brain Holdings and Efficient Frontier among others. The proceeds acquired from this financing round will faciliate ZkLink’s plans to launch its mainnet in the third quarter of 2023.

Up to date, the firm has raised a total of $18.5 million in finances.

Infrastructure projects have proved resilient in the current bear market as investors and venture capitals are showing confidence in investing in such startups. The firm is however, about to face tough competition in the zk market as more startups offering products based on the technology are on the rise. Andreessen Horowitz, a notable venture capital, has in its annual report highlighted zk technology and its potential in the crypto industry. Other firms have joined in the race for this technology including Polygon and Matter Labs that have announced the mainnet launch zk-EVM(Ethereum Virtual Machine) products within days of each other. This healthy competition is set to give rise of a new generation of top-tier rollups that inherit the same level of security from layer-1 chains, efficient and scalable at low costs.

ZkLink on the other hand, is set to launch 2 initiatives ahead of its own mainnet launch. These initiatives include ‘Odyssey’ – a community campaign, and ‘Dunkirk’ – an asset withdrawal test. The firm’s pioneering multi-chain ZK-rollup architecture is built for zero security compromises and optimized for high performance trading with app-specific zk circuits.

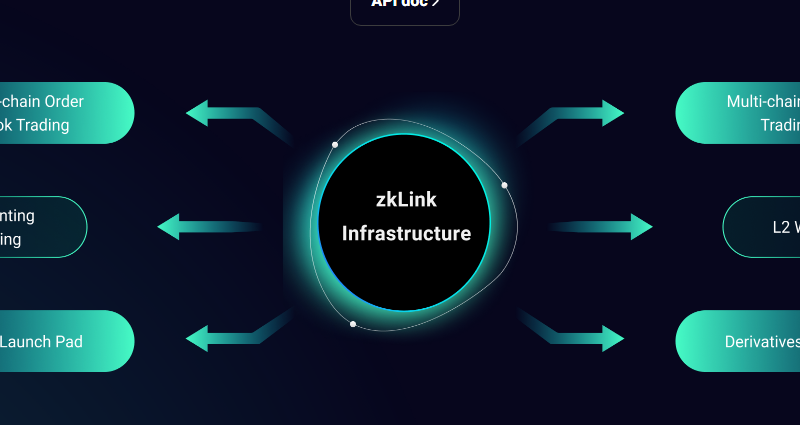

ZkLink’s decentralized trading layer connects layer 1 chains to layer 2 protocols therefore, making it easy for developers to utilize its APIs(Application Programming Interfaces) to create a wide range of products including order books decentralized exchanges and NFT marketplaces. The infrastructure layer also aggregates native assets from multiple layer 1 and layer 2 chains and protocols to enable users list and trade tokens across chains without a bridge as well as manage multi-chain portfolios with a single wallet. This technology is beneficial to DeFi as it is trustless and non-custodial.